Dad’s advice: Ageless wisdom or old-school?

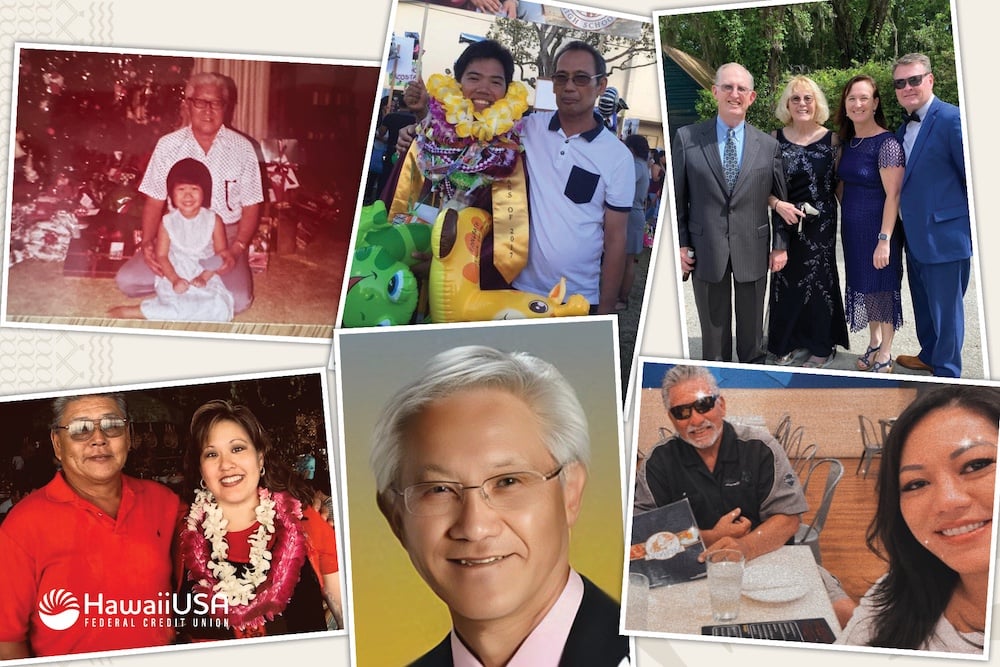

Have you received money advice from a father or father-figure? For these HawaiiUSA financial coaches, what was once met with adolescent eyerolls is now recognized as wisdom.

Saving

Dana Low’s dad, Jordan Rose, would say “Don’t toss those pennies! Dedicate a small container to collect loose change. Every 6 months, deposit it into your savings account.” Dana learned that consistency is the key to saving, without getting overwhelmed.

“Make sure you save some money in case you need it,” reminded Jeremy Butac’s father, Robert Butac. Jeremy now practices his father’s advice. “Every time I get paid, I allocate an amount to save in an easily accessible account.”

Spencer Hoos’ advice to daughter Katey Mobley may sound familiar: “Money doesn’t grow on trees,” he would say. But the explanation is what stuck with her. “You have to earn it and save it.” And Katey does.

Spending

“Before making a significant purchase, take a few days to reflect,” cautioned Rene Tam Ho’s father, Richard Nakasue. “At the time, I was 15 and thought that my dad was just trying to prevent me from spending money. As I matured, I realized that sometimes I bought things based on my mood. Now I interpret his words as ‘Don’t go shopping when you are sad, stressed, mad, or need a pick-me-up because it leads to overspending on frivolous things that negatively impact your budget.’ By waiting a few days, I realized that I didn’t really need or want the item.”

Borrowing

Taylor Shigemoto’s dad, Tom Shigemoto, says “One of the greatest things you can do (for free!), is build your credit history and credit score by staying committed, disciplined, and focused. Doing this can save you thousands of dollars in your lifetime!”

Planning

James “Jim” Sasaki’s words of wisdom to granddaughter Lauren Sodetani-Yoshida came from the hardship he and his wife endured when they were sent to internment camps during WWII. “The best ‘investment’ is investing in yourself through education, whether it is formal/academic or skill-based. No one can ever take away what you’ve learned (through books, degrees, and/or skills).”

HawaiiUSA’s financial coaches are certified professionals who have completed a rigorous study and testing program, in addition to their everyday roles at the credit union. They provide complimentary guidance to help individuals improve their financial health.

Get in touch with a financial coach today to get started with saving for emergencies, planning for your future, and more.

808.534.4300