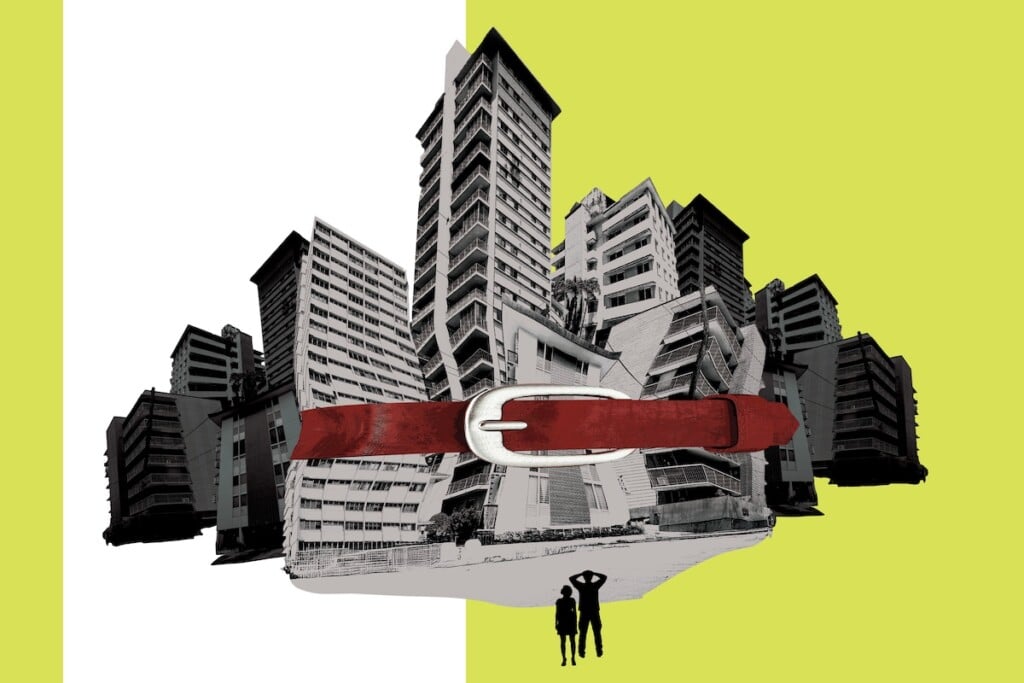

Condos Under Pressure

Rising insurance rates continue to squeeze condo owners on O‘ahu, but relief may be in sight

An ongoing insurance crisis has hurt condo sales on O‘ahu: Prices are down and properties are lingering on the market more than three times longer than in 2022.

The biggest factor is the rising price of insurance. When the insurance coverage on a condo building is not 100% of the cost to rebuild, many banks and other mortgage lenders are reluctant to lend money to people wanting to buy condos there.

“The challenges we face with condo insurance – rising costs, accessibility and coverage – are complex, with no clear solutions yet,” says Trevor Benn, president of both the Honolulu Board of Realtors and real estate firm Forward Realty, via an email interview. “Lenders are trying to find nonsalable loan solutions while we continue to press our legislators nationally and locally for assistance.”

The U.S. and much of the rest of the world have suffered more frequent and more powerful coastal flooding, wildfires, hurricanes and windstorms in recent years. That’s led to more catastrophic claims, Benn notes, with huge losses for insurers that are then shared with customers in the form of higher rates.

In fact, global reinsurance losses have exceeded $100 billion annually for several consecutive years, reports Jorge Martinez Marin, via an email interview. Marin is a producer at Honolulu-based insurance agency ACW Group, which writes insurance policies for condominium associations across O‘ahu, Hawai‘i Island, Kaua‘i and Maui.

“And multiple admitted carriers such as FICOH, Fireman’s Fund and DB Insurance are not writing new business/policies.” Additionally, he notes, “Surplus carriers are reducing capacity and requiring agents to build layered ‘insurance towers’ of multiple carriers to fully insure properties.”

Older Buildings Need More Repairs

Compounding the problem is the aging infrastructures of many of Honolulu’s condo buildings. For instance, old plumbing is more likely to break down and a single leak can damage multiple condos, leading to more insurance claims and higher premiums.

“[Insurance] carriers increasingly inquire about plumbing age, as water damage remains the state’s leading claims driver,” says Marin. “Consequently, water damage deductibles have risen from $5,000 to a market norm of $50,000, with some properties facing deductibles as high as $250,000.”

Many condo associations have experienced insurance premium increases ranging from 300% to 600% over the past two years. Often the buildings hit hardest are those that have fallen behind on maintenance and replacement of things like plumbing and electrical systems. These costly repairs must be paid by special assessments and increases in association fees.

“An average condo association fee is about $1,000 in Hawai‘i, so that’s like a whole other mortgage,” says Stephany Sofos, principal at SL Sofos, in a telephone interview. “It’s about $1.25 to $1.75 per square foot for a maintenance fee. When I moved into my condo 20 years ago it was $500, and now it’s $1,500. It’s prohibitive to many.”

Sofos, who’s also a real estate consultant, appraiser and broker in Honolulu, personally sold two one-bedrooms condos within the past two to three years, one for $425,000 and one for $435,000. Now, the same type of unit in the same building is selling for $390,000 to $410,000, she says.

Rising insurance costs reduce market value, Marin explains: For every $100 increase in monthly fees, a condo loses $20,000 in value.

The 2017 Marco Polo high-rise fire – which left four people dead, caused more than $100 million in damage to the building and led to dozens of lawsuits – spurred state legislation in 2023 requiring the installation of fire sprinkler systems in older high-rises, adding another financial burden for condo associations and owners.

Lower Prices, More Condo Inventory

Benn says the Honolulu Board of Realtors’ monthly report shows the median condo sales price in April 2025 was down 4.4% compared to April 2024. The median number of days condos spent on the market before selling went from 12 in April 2022 to 43 in April 2025. Inventory – a measure of how many condos are available for sale – went from 1.5 months’ worth to 6.8 months during that period.

“The market has certainly shown some resiliency, but condos are lower in price, and inventory is growing,” Benn says. “Condo prices have been affected by many factors, including rising insurance costs, pipe replacements, fire alarm/suppression systems, and more.”

“The correlation would seem that as monthly costs rise, values are negatively affected, and more owners may choose to sell.”

He provides historical perspective. “The condo market has been essentially flat for the past three years. We saw a large bump in values during the Covid stimulus (almost 40% in two years), and now we have leveled off. This is exactly how the Hawai‘i real estate market historically works. We have bursts of appreciation followed by flat or even slightly downward periods. All told, when looked at with the benefit of time (going back 50 years), we tend to appreciate about 4-5% a year.”

“If we look at the bigger picture across a broader period of time, our most recent statistics for April show that year-to-date sales are down 2.3% compared to 2024 and 6.5% compared to two years ago.”

By the end of April, the year-to-date median price for condos was $510,000, Benn reports; that’s unchanged from a year ago and up 2% from two years ago. Year-to-date median days on market increased to 43, up from 31 days a year ago and 24 days two years ago.

Additionally, Benn notes O‘ahu’s changing buyer demographics. “The strong U.S. dollar has made Hawai‘i real estate less attractive to Japanese investors, who were once a significant part of the condo market. In some cases, they are now selling off their properties instead of buying.”

Advice for Buyers and Owners

However, while sellers face more challenges in this market, buyers, with additional properties to choose from and more leverage to negotiate, have more opportunities.

“I recommend buyers prioritize properties with recently updated plumbing and proactive, engaged boards,” says Marin. “Deferred maintenance – particularly plumbing – can result in costly future assessments and high insurance premiums. For example, a 24-story, 140-unit building in Waikīkī is currently investing $3.2 million to replace its plumbing system,” he says.

“That said, properties with higher fees but strong reserves and diligent maintenance can maintain or even enhance their market value.”

Current condo owners can protect their investment by staying informed on what the condo association board is doing, ensuring regular maintenance is performed on a timely schedule, and that any structural issues are dealt with promptly.

Lawmakers Voted to Provide Relief

In May, the Legislature passed a bill that seeks to stabilize the property insurance market in the state. It expands the powers of the Hawai‘i Property Insurance Association and reactivates the Hawaii Hurricane Relief Fund. If signed by Gov. Josh Green, the bill will provide relief to condo associations in need of secondary insurers and low-cost loans for maintenance and big-ticket repairs – like adding those sprinkler systems – that in turn reduce risks to insurers.

“The government had to do something,” observes Sofos. “The average person cannot afford the rates the way they are going up.”

Additionally, the insurance burden adds to the housing availability crisis. “The government wants to build more housing, and the only way to do that is to go vertical. We can’t keep building laterally, particularly in Honolulu. So, to do affordable housing, senior housing, any housing, you have to go vertical,” she says. “They have to do something to balance the costs.”

She says the insurance situation will not be easily resolved, but she predicts a major correction.

For his part, Marin is hopeful that the proposed insurance bill will be signed into law. “While implementation details, funding structure and allocation processes are still being finalized, the fact that the issue is receiving attention is an encouraging and necessary step.”

Some Condo Buildings Are on Blacklists

Fannie Mae was created by Congress during the Great Depression to ensure enough funds are available nationwide to support residential mortgage lending. Fannie Mae is also keeping a “blacklist” of condos, including in the Islands – a development first reported nationally by the Wall Street Journal in March.

The list grew following the 2021 collapse of the Surfside condo near Miami, Florida. If a condo building is on the blacklist, it’s much harder to get a mortgage on a condo there, which in turn can reduce the value of all condos in that building.

The blacklist especially affects markets in states that have been hard-hit by climate disasters, including Florida, Texas, Colorado, California and Hawai‘i. Regulators are being stricter with building safety and financial requirements, examining factors such as how much money a condo association has in reserve, if there’s any pending litigation, and any unaddressed structural or safety concerns.

For example, “federally backed lenders such as Fannie Mae require 100% hurricane coverage,” explains Jorge Martinez Marin, a producer at Honolulu-based insurance agency ACW Group. He says a blacklist of over 400 Hawai‘i properties without adequate coverage is maintained by some local banks.

The catch? The Fannie Mae list is not publicly available. Your loan officer can help you gain information.

“Some condos have chosen to comply with Fannie Mae guidelines, and others have determined that the costs do not justify the benefits,” says Trevor Benn, president of the Honolulu Board of Realtors and the firm Forward Realty. Each condo association can make its own decision, he says, “So, it behooves the Realtors and lenders to check with each individual building.”

“Buyers should work with their Realtor to get the most recent set of condo documents, ask specifically about insurance coverage and inquire about looming assessments. Talking to the management company and reviewing financial records is essential to understanding what costs may be coming.”