New Opportunities for Financial Providers to Grow Engagement and Deposits

Turning data into action is hard. Fueled by several trends, we have a huge opportunity to more effectively use data to grow engagement and deposits.

- Open Banking as a Competitive Advantage:

Financial institutions that adopt Open Banking and compete to deliver the best experience will be more likely to earn consumer loyalty and engagement for the long term. With Open Banking, financial providers can unlock the door to gain better insights about competitor products that their customers utilize and create precise targeting and compelling offers. - Educating in the Fight Against Fraud

Fraud cases continue to reach new highs each year, with no signs of slowing down. While the right systems and processes matter, organizations also need to remember the human element. Those who invest in modernizing systems and improving customer communications and onboarding will earn and keep a consumer’s trust and business for the long term. - Prioritizing Financial App Functionality

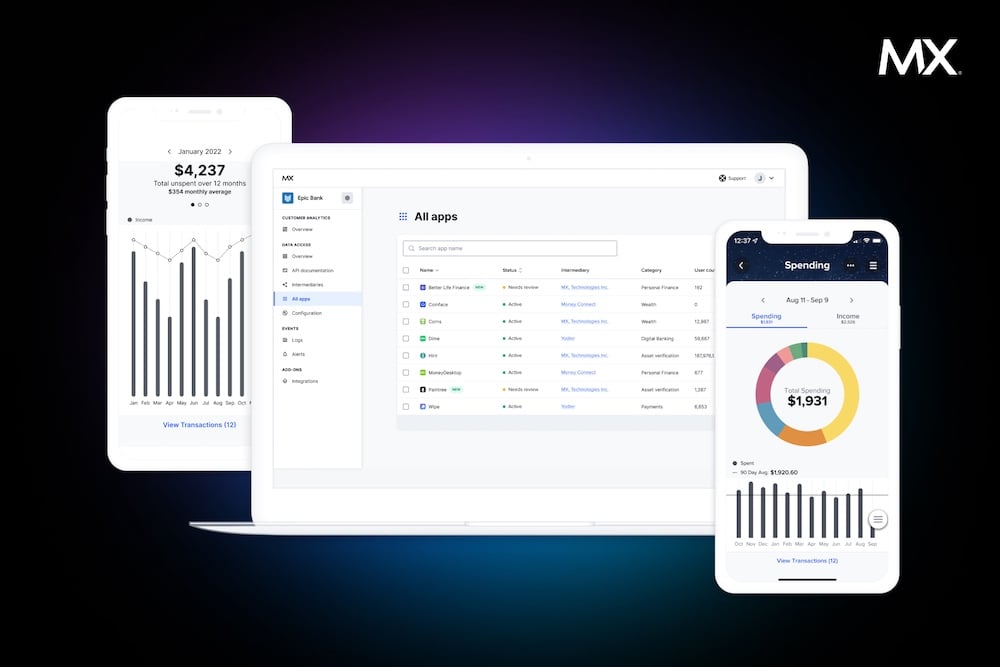

The average consumer has 3 or more finance-related mobile apps on their phone today, according to MX’s consumer research. We expect consumers will start to demand more guided financial tools that meet them where they are — i.e., the app they use most often — rather than a do-it-yourself money management approach that requires them to access a multitude of apps and websites. - AI Requires a Better Data Strategy

AI is only as good as the data that powers it. Financial institutions who take a step back to build the right data foundation to fuel AI use cases — and prevent use cases that could cause inadvertent harm — will meet customer expectations and business needs.

About MX: Learn more at mx.com.