Spread Out Your Taxes (This Year Only)

It’s not every day that the federal government allows people to pay taxes over two years instead of one.

But that’s what it’s offering to those who convert their traditional individual retirement accounts into Roth IRAs. The catch is people have to make the conversion decision by midnight Dec. 31; then, they can pay half of the income tax due in 2011, and the other half in 2012.

The one-time tax break is part of a law that also allowed the conversions for people making more than $100,000 a year.

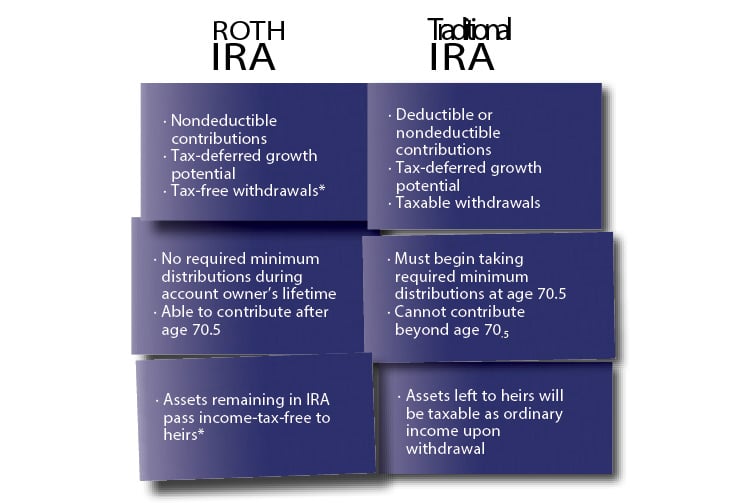

Contributions to traditional IRAs and income growth within them aren’t taxed until withdrawal. Contributions to Roth IRAs are taxed, while generally income growth and withdrawals aren’t. People converting traditional IRAs to Roth IRAs pay tax on the amount converted.

Local financial executives say the conversion makes sense for some people, but not all. At the Honolulu office of Morgan Stanley Smith Barney, Second VP Grant K.T. Kubota says folks who are looking for ways to pass money on to their heirs tax-free may find the program attractive.

Roth IRA

He also says it can be tied in with charitable donations to minimize the spike in tax liability.

Roberta Lee Driscoll, a Hawaii certified financial planner, says people shouldn’t think splitting the tax payments over two years automatically will be a good thing. Tax rates can always change, she says.

“The only thing people know for sure is the 2010 tax rates,” explains Driscoll, who also says people should have a plan for paying the taxes before they decide to convert.